The Australian property market has once again proven its resilience and allure, attracting a staggering $10 billion in foreign investments during the 2023–24 financial year. This influx of capital is reshaping the landscape of real estate across the country, with international buyers showing strong interest in key markets. So, what’s fueling this flood of foreign investment, and how can Australian property players make the most of it? Let’s break it down.

Also Read: A-Z Guide to Buying Property in Australia for Foreign Investors

Why Investors Are Turning to Australian Real Estate

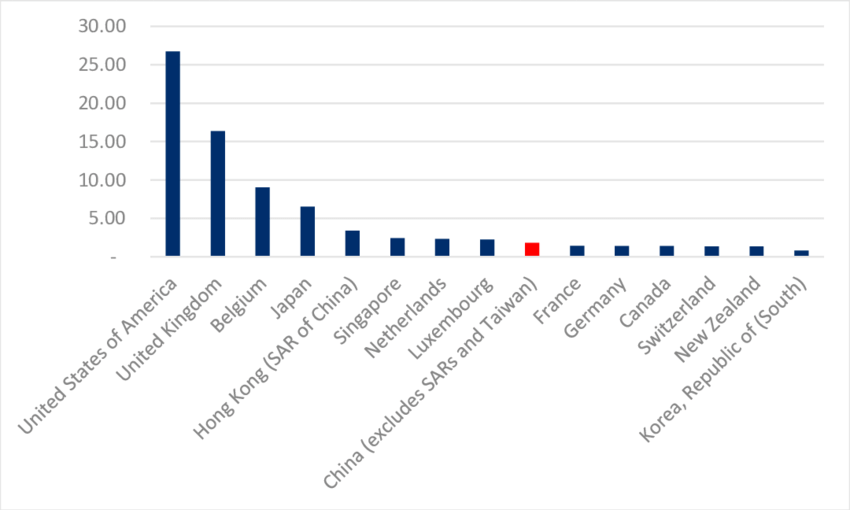

Australia’s real estate market has long been a magnet for international investors, and 2023–24 has been no different. A combination of stable economic performance, favorable currency conditions, and Australia’s reputation as a safe and transparent market has driven up demand. Dollar depreciation against other major currencies has made Australian property more affordable for offshore buyers, particularly from Asia and Europe.

According to industry data, the most attractive segments for foreign investors this year have been high-end residential properties, industrial assets, and mixed-use developments. Major cities like Sydney, Melbourne, and Brisbane continue to lead the charge, while regional areas are also gaining traction for their lower entry points. How Buyers Are Taking Control of Australia’s Real Estate Market

The Numbers Behind the Boom

The $10 billion in foreign inflows marks a significant step-up compared to previous years, signaling a renewed appetite in the market post-COVID. The figures include a mix of new property purchases, investments in large-scale developments, and acquisitions of commercial real estate.

- High-end residential: Luxurious homes and apartments in cities like Sydney and Melbourne remain hot commodities.

- Industrial properties: The booming e-commerce industry has boosted demand for warehouses and logistical hubs, particularly near major cities.

- Mixed-use developments: Projects combining residential, retail, and office spaces have been increasingly popular.

For a detailed breakdown of recent property trends and investment figures, review the original article here.

What This Means for Australian Sellers and Developers

Foreign investment not only provides a financial boost but also increases competition in the property market. For local sellers, this could mean higher property valuations, stronger demand in high-performing suburbs, and faster sell-through times. Developers, on the other hand, may notice increased international interest in off-the-plan sales and major projects.

However, the influx of investors also highlights the ongoing challenge of affordability for local buyers, especially in metro areas. Policymakers are keeping a pulse on these trends to ensure that international investments don’t overshadow domestic purchasing power.

How to Capitalize on this Trend as a Marketer

If you’re in the real estate sector, now is the time to adjust your marketing strategies to appeal to international buyers. Here’s how:

- Boost online visibility: Target keywords in multiple languages and optimize your website for international SEO.

- Leverage social proof: Highlight testimonials from previous international buyers and major deals you’ve brokered.

- Partner with international platforms: Advertise your properties on global real estate marketplaces to maximize visibility.

- Focus on transparency: Provide clear, detailed information about the property, its location, and the purchasing process.

The Australian property market continues to outshine global competitors, and this year’s $10 billion foreign investment influx underlines its international appeal. By understanding the forces at play and tailoring your strategies accordingly, you can stay ahead in this thriving space.

Sources: