The Australian property market has been on a rollercoaster ride in recent years, with prices soaring to record highs before experiencing a slight downturn in late 2024. So, what’s the outlook for the property market in 2025? Will it be a boom year or a bust?

Key takeaways

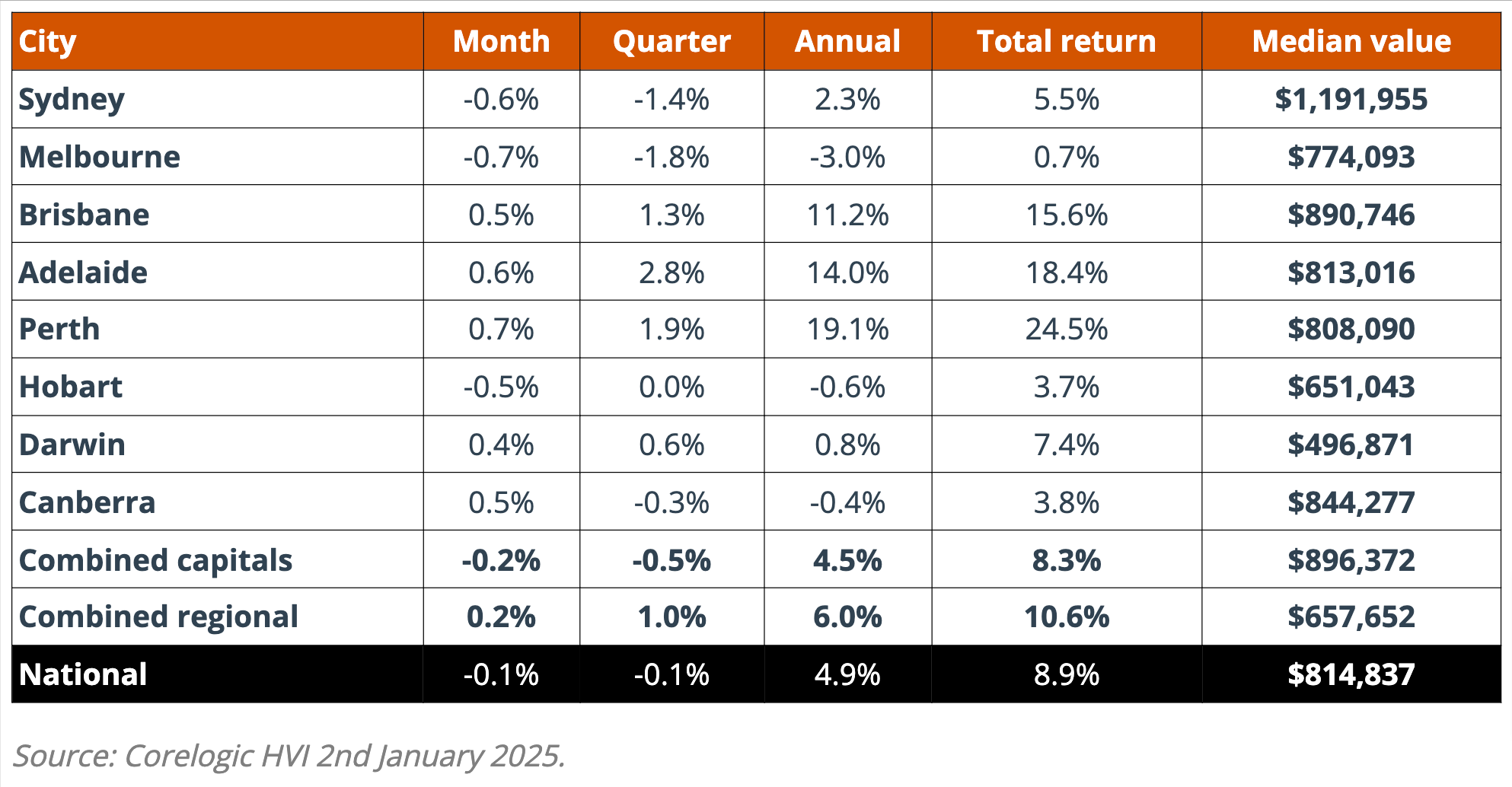

- The national house price decline in December 2024 is likely to be shallow and short-lived.

- Australia’s housing shortage is expected to worsen, putting upward pressure on prices.

- Interest rates are predicted to fall in mid-2025, stimulating buyer activity.

- Rents are expected to continue rising throughout 2025.

- Strong population growth and demographics will continue to fuel demand for housing.

- Strategic investors are likely to return to the market as rental yields increase.

Market trends to watch in 2025

- A tale of two halves: The property market is expected to experience a two-speed growth pattern in 2025. Initially, price growth will be slow in some locations and may even dip slightly. However, a surge in buyer activity is anticipated once interest rates fall.

- Market fragmentation: Property market performance will vary across states and regions due to local economic factors. Capital city markets are expected to outperform regional markets.

- Interest rate fluctuations: Interest rates are likely to fall in mid-2025, making borrowing more affordable and boosting buyer confidence.

- Continued migration: Australia’s strong migration rates will put upward pressure on rents and may lead to price increases in some areas.

- Soaring rental prices: Rents are expected to keep rising in 2025 due to the ongoing rental crisis and scarce supply of dwellings.

- Strategic investor resurgence: As rental yields increase, strategic investors are likely to re-enter the market, potentially squeezing out some first-home buyers.

- The rise of the 20-minute neighborhood: People will increasingly prioritize living in walkable, bikeable, or easily accessible neighborhoods that offer a variety of amenities within a 20-minute radius. This trend is likely to benefit inner and middle-ring suburbs of capital cities.

What are the experts saying?

- ANZ Bank forecasts capital city housing prices to grow by 2.7% in 2025 and 4.1% in 2026.

- NAB also predicts moderate price growth in 2025.

- Dr. Andrew Wilson, chief economist of My Housing Market, believes property values will rise in 2025, with strategically chosen properties in the right locations potentially outperforming the market average.

Factors supporting market growth

- Persistently low supply: The undersupply of housing relative to demand is a major factor supporting property values despite rising interest rates and affordability constraints.

- Wealthy buyers: Wealthy buyers with large deposits are entering the market, helping to prop up prices.

- Downsizers: Downsizers who have accumulated significant equity in their homes are buying debt-free, further stimulating the market.

- Government support: The bank of mum and dad and inheritance are helping many first-home buyers secure deposits.

Headwinds to Consider

- Affordability: Affordability remains a major challenge for many potential buyers, potentially limiting their purchasing power.

- Interest Rate Hikes: Any unexpected interest rate hikes could dampen buyer sentiment and slow down the market.

- Economic Uncertainty: Job security concerns and overall economic uncertainty may lead some people to delay property purchases.

Conclusion

The Australian property market in 2025 is poised for a period of continued growth, albeit at a potentially slower pace than in previous years. While challenges such as affordability and economic uncertainty remain, the fundamentals of strong demand and limited supply are likely to support market stability. Strategic investors and homebuyers who carefully consider location, property type, and long-term market trends are likely to navigate the market successfully.

If you’re considering buying or investing in property in 2025, it’s crucial to conduct thorough research and seek professional advice.

A qualified real estate agent can provide valuable insights into local market conditions and help you make informed decisions.

Ready to take the next step?

Schedule a free discovery call with me to discuss your specific property goals and explore how we can help you achieve them.