Estimated reading time: 3 minutes

You’ve probably heard the terms ‘Capital Growth’ and ‘Cash Flow’ thrown around a lot in property investment circles. But what do they actually mean, and which one is right for you? Let’s dive in.

What’s inside?

What is Capital Growth?

Capital growth is the increase in the value of your property over time. It’s like watching your investment appreciate, much like a fine wine (though hopefully without the waiting period!). For example, if you bought a property for $500,000 and it’s now worth $700,000, you’ve enjoyed a capital growth of $200,000.

How to Boost Capital Growth:

- Location, location, location: Invest in up-and-coming areas with high growth potential.

- Renovations and additions: Improve your property’s value and appeal.

- Unique properties: Stand out from the crowd with something special.

Remember, while capital growth can be lucrative, it’s not guaranteed. Market fluctuations can impact property values.

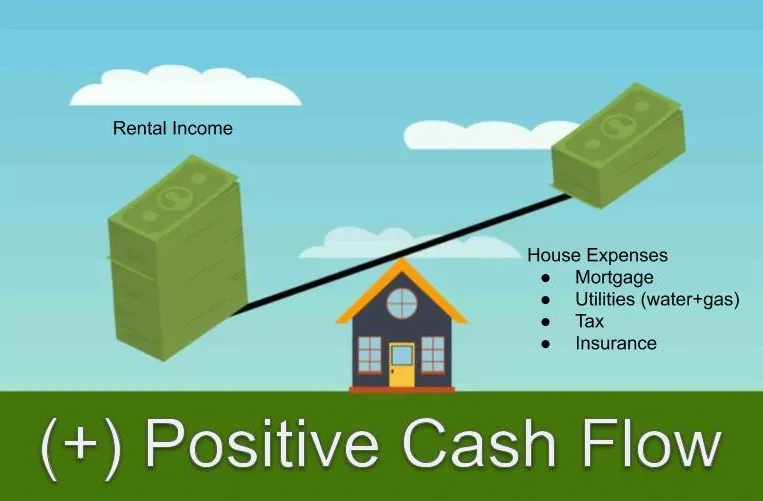

What is Positive Cash Flow?

Positive cash flow means your rental income exceeds your expenses (mortgage repayments, property taxes, maintenance, etc.). It’s like having your property work for you, generating income to cover costs and even provide extra cash. Co-Living: A New Trend In Rental Investment Housing

Benefits of Positive Cash Flow:

- Financial stability: Consistent income to cover expenses.

- Investment growth: Reinvest rental profits to build your property portfolio.

- Lifestyle benefits: Extra income for vacations, hobbies, or savings.

To achieve positive cash flow, look for properties in areas with high rental demand and lower property prices.

Capital Growth or Cash Flow: Which is Better?

The age-old question! The answer depends on your financial goals and risk tolerance.

Choose Capital Growth if:

- You’re a long-term investor looking to build wealth.

- You can handle negative cash flow initially.

- You’re comfortable with market fluctuations.

Choose Cash Flow if:

- You need immediate income generation.

- You prioritize financial stability.

- You prefer a lower-risk investment strategy.

Finding the Perfect Balance

The holy grail of property investment is a combination of both capital growth and positive cash flow. It’s challenging but achievable. Consider these options:

- Dual occupancy: Build a secondary dwelling on your property to generate rental income while maintaining capital growth potential.

- Regional areas: Some regional locations offer strong rental yields and capital growth opportunities.

- Co-living: Invest in properties specifically designed for shared living arrangements, which can provide high occupancy rates and cash flow. Explore now

Other Investment Considerations

- NDIS (National Disability Insurance Scheme): Investing in properties suitable for NDIS participants can offer stable rental income. Explore NDIS Opportunities

- SMSFs (Self-Managed Super Funds): Using your superannuation to invest in property can provide tax benefits and long-term growth. Explore SMSF Properties

- Internation Investments: Enjoy up to 18% annual returns while experiencing the epitome of luxury living in Bali, Indonesia. Explore now

Remember: Property investment is complex. Seek advice from professionals to create a strategy tailored to your financial situation and goals.