Looking to buy your first home?

Owning a home has long been a cherished dream for many, and in 2023, that dream is becoming a reality for thousands of Australians through the Home Guarantee Scheme. This innovative program has been revamped and expanded, offering numerous benefits to a wide range of aspiring homeowners, including first home buyers (FHB), regional first home buyers (RFHB), single parents, and guardians. With an allocation of 50,000 new places every financial year, the Home Guarantee Scheme has set the stage for a brighter future for countless Australians.

Home Guarantee Scheme:

Breaking Down the Benefits

1. Accessible for Various Demographics

One of the most remarkable aspects of the updated Home Guarantee Scheme is its inclusivity. It allocates 35,000 places to first home buyers, recognizing the significance of helping individuals and families take their first step onto the property ladder. Furthermore, 10,000 places are reserved for regional first home buyers, aiming to address the housing disparities faced by those living outside major metropolitan areas. Additionally, 5,000 places are specifically earmarked for single parents and guardians, acknowledging the unique challenges they face in achieving homeownership.

2. Minimal Deposit Requirements

Traditionally, one of the biggest hurdles to homeownership has been the hefty deposit required to secure a home loan. The Home Guarantee Scheme addresses this issue by allowing first home buyers and regional first home buyers to apply for a home loan with a deposit as low as 5%. This reduction in the deposit threshold makes homeownership much more attainable for many who would otherwise struggle to save a substantial sum.

For single parents and guardians, the scheme goes even further by enabling them to apply for a home loan with a deposit of just 2%. This level of financial support recognizes the unique challenges faced by this demographic and provides a lifeline towards securing stable housing for themselves and their dependents.

3. No Lenders Mortgage Insurance

Lenders Mortgage Insurance (LMI) has often been an added expense that discourages potential homebuyers. However, the Home Guarantee Scheme removes this requirement, making homeownership more affordable and accessible. This means that participants in the scheme won’t have to worry about paying LMI, a significant cost saving that can make a big difference in the long run.

4. Diverse Property Options

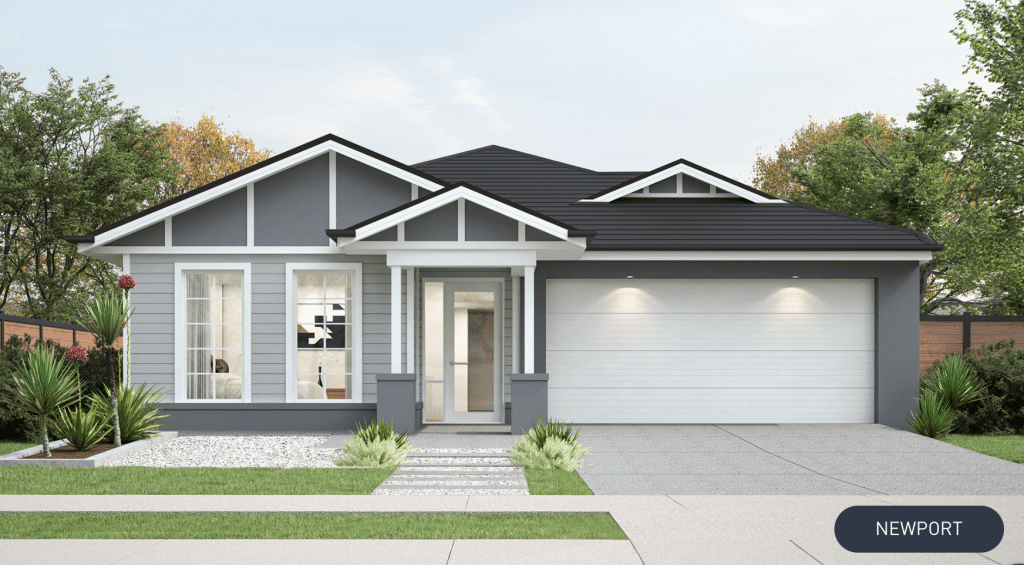

The Home Guarantee Scheme is designed to cater to a variety of property types, ensuring that participants have options that suit their needs and preferences. Whether you’re interested in a detached house, an apartment, or a townhouse, the scheme allows for flexibility in choosing the type of property that best fits your lifestyle and budget.

Property Types Eligible for FHBG, RFHBG, and FHG

One of the key aspects of the First Home Guarantee (FHBG), Regional First Home Guarantee (RFHBG), and Family Home Guarantee (FHG) is the flexibility they offer in terms of the types of properties that are eligible for these schemes. Eligible properties must fall under the category of “residential property.” Here are the property types that qualify for these programs:

1. Existing Houses, Apartments, or Townhouses

The FHBG, RFHBG, and FHG schemes allow participants to purchase existing residential properties, including houses, apartments, and townhouses. This option provides buyers with a wide range of choices in established neighborhoods and communities.

Benefits

- Immediate occupancy: Buyers can move into their new home right away.

- Established neighborhoods: Access to established amenities and services in the area.

2. House and Land Packages

For those who prefer a more hands-on approach to homeownership, house and land packages are eligible under these schemes. This option typically involves purchasing a block of land in a residential development and then contracting a builder to construct a house on that land.

Benefits

- Customization: Buyers can often choose from a range of house designs and tailor them to their preferences.

- New construction: The house is built to contemporary standards with the latest features and technology.

3. Land with a Separate Contract to Build a Home

Under these schemes, purchasing a piece of land with a separate contract to build a home is also eligible. This option allows buyers to secure a suitable piece of land and then engage a builder to construct a house on it separately.

Benefits

- Greater control: Buyers have more control over the design and construction of their home.

- Choice of location: Flexibility to choose the land in the desired location.

4. Off-the-Plan Apartments or Townhouses

Off-the-plan properties, such as apartments or townhouses that are not yet completed, are also considered eligible for FHBG, RFHBG, and FHG. Buyers can secure these properties while they are still in the planning or construction phase.

Benefits

- Potential for capital growth: Property values may increase by the time construction is completed.

- Modern amenities: Newer buildings often come with contemporary features and energy-efficient designs.

It’s important to note that while these property types are generally eligible, specific eligibility criteria and guidelines may vary depending on the scheme and government regulations in place at the time of application. Therefore, individuals interested in participating in any of these schemes should consult with approved lending institutions and relevant government authorities for the most up-to-date information and guidance on property eligibility.

In conclusion, the FHBG, RFHBG, and FHG programs offer a diverse range of property types to suit the preferences and needs of aspiring homeowners. Whether it’s an existing property, a house and land package, land with a separate construction contract, or an off-the-plan apartment, these schemes provide opportunities for individuals and families to take their first steps towards homeownership in Australia.

Property Price Thresholds

| State | Capital city & regional centres* | Rest of State |

|---|---|---|

| NSW | $900,000 | $750,000 |

| VIC | $800,000 | $650,000 |

| QLD | $700,000 | $550,000 |

| WA | $600,000 | $450,000 |

| SA | $600,000 | $450,000 |

| TAS | $600,000 | $450,000 |

* The capital city price thresholds apply to regional centres with a population over 250,000 (Newcastle & Lake Macquarie, Illawarra (Wollongong), Geelong, Gold Coast and Sunshine Coast), recognising that dwellings in regional centres can be significantly more expensive than other regional areas.

Source: The National Housing Finance and Investment Corporation (NHFIC)

How to Apply for Home Guarantee Scheme

Taking advantage of the Home Guarantee Scheme is a straightforward process. Eligible individuals need to meet the specific criteria outlined by the scheme and work with approved lending institutions. It’s advisable to consult with a financial advisor or mortgage broker who can guide you through the application process and help you make informed decisions about your home loan.

Conclusion

The Home Guarantee Scheme – Update 2023 is a testament to the Australian government’s commitment to making homeownership a reality for a broader range of citizens. With its emphasis on inclusivity, reduced deposit requirements, and the elimination of Lenders Mortgage Insurance, the scheme has opened doors for thousands of aspiring homeowners. Official website

As the housing market continues to evolve, the Home Guarantee Scheme stands as a beacon of hope, providing a clear path to affordable homeownership for first home buyers, regional first home buyers, single parents, and guardians. This program not only fosters financial stability but also strengthens communities by helping individuals and families secure their place in the Australian dream of homeownership.

GET IN TOUCH