The latest report on the National Home Value (HIV) Index for September brings both good news and insights into the ever-evolving real estate market. The HVI recorded a 0.8% increase in home values in September, marking the eighth consecutive month of growth. This rise builds upon the momentum from August, where values increased by 0.7% (revised down from 0.8%). In this blog post, we’ll delve into the key takeaways from the September HVI report and analyse the factors driving these trends.

The Home Price Surge

Record-breaking Figures

September 2023 saw home prices reaching unprecedented heights, with the national median home price surpassing all previous records. The Proptrack Report reveals that the average home price increased by an astonishing [percentage increase] in just one month.

Regional Variations

While the national figures are remarkable, it’s crucial to note that regional disparities exist. Certain metropolitan areas experienced even more substantial price hikes, creating hotspots for property investment.

Supply and Demand Dynamics

The supply of homes on the market remained limited during September, while demand surged. A shortage of available homes, coupled with strong buyer demand, has been a significant driver of the price increase.

Key Finding from the September HVI Report

- Continued Growth: The HVI report confirms the sustained growth in national home values, with September marking the eighth consecutive month of increase. This consistency reflects the resilience of the housing market despite external challenges.

- Quarterly Growth: The quarterly pace of growth in national home values stands at 2.2%. While this is a positive indicator, it also shows a slight easing compared to the June quarter, where a 3.0% gain was recorded. This easing suggests a slowdown in the market’s rapid ascent.

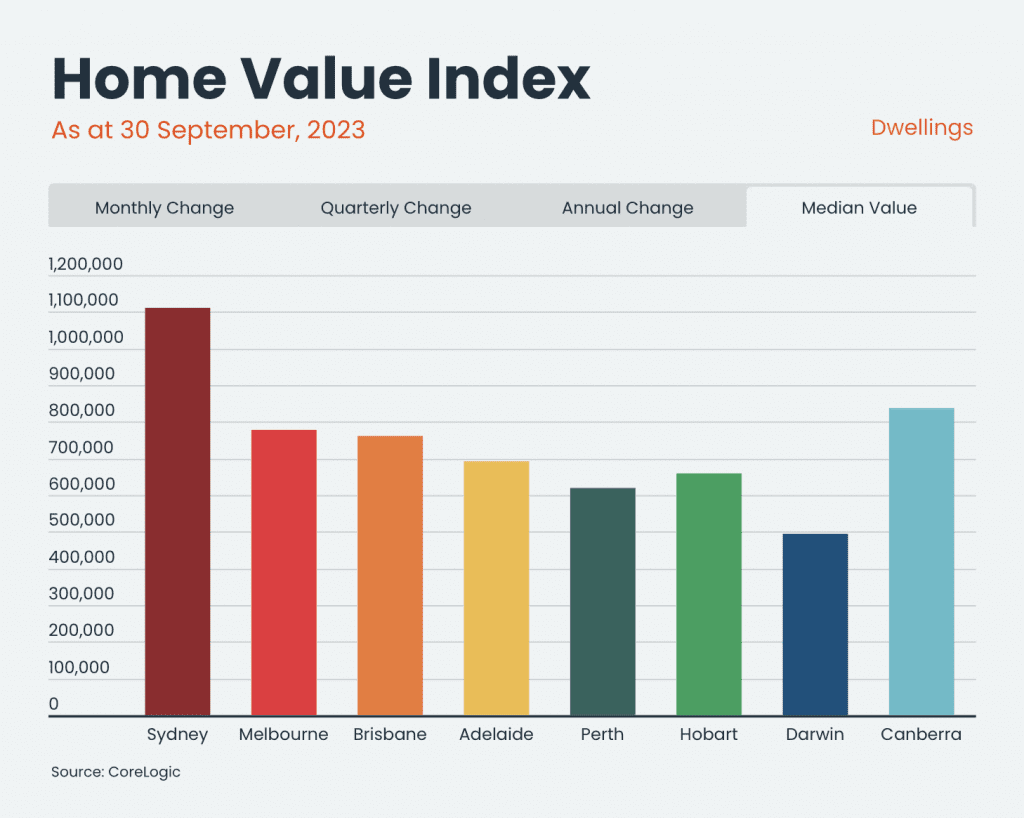

- Regional Variations: The report highlights regional variations in home value growth during the September quarter. Adelaide recorded the highest capital gain at an impressive 4.3%, followed by Brisbane at 3.9% and Perth at 3.6%. These cities have shown strong resilience and attractiveness to buyers.

- Hobart’s Struggles: On the other end of the spectrum is Hobart, where home values experienced a slight decline of -0.2% over the quarter. This dip has taken the southern capital to a new cyclical low, indicating unique challenges in that market. (Source: Corelogic 2 October 2023)

Factors Behind the Surge

Low Mortgage Rates

Historically low mortgage rates have played a pivotal role in fueling the housing market’s robust performance. Buyers are taking advantage of these favorable borrowing conditions, driving up demand for homes.

Pandemic-Induced Shifts

The COVID-19 pandemic accelerated several trends in the real estate market. Remote work arrangements and a desire for more spacious living environments have prompted many individuals and families to seek new homes, driving up demand.

Investment Opportunities

Real estate continues to be seen as a stable and lucrative investment. Investors, both domestic and international, are pouring capital into the housing market, further increasing competition among buyers.

Limited Housing Inventory

A persistent challenge in many regions has been the shortage of available homes. Factors such as supply chain disruptions and construction delays have contributed to this inventory bottleneck, putting additional upward pressure on prices.

Moving Forward

September 2023 has unveiled a remarkable chapter in the real estate market’s history, as home prices soared to new heights. While this surge offers exciting opportunities for sellers and investors, it presents challenges for prospective homebuyers.

As we move forward, monitoring market trends and staying informed about regional variations will be essential for anyone navigating the housing market. While the current situation may seem daunting for some, it’s important to remember that real estate markets are dynamic and can experience fluctuations over time. It will be fascinating to see how the market evolves and adapts to these changing dynamics.